The Cost of a Superficial Advisor-Client Relationship

Discover why great financial advice often goes ignored. Dr. Moira Somers shares powerful insights on behavior, systems and the human side of money.

Table of Contents

Hi friend,

This week on Millennial Money Canada, we had the absolute pleasure of sitting down with Dr. Moira Somers—a neuropsychologist, executive coach, and author of the bestselling book Advice That Sticks. And let’s just say... her insights could change how you think about giving (or receiving) financial advice forever.

Whether you're an advisor, a business owner, or just someone trying to build better habits around money, this conversation was packed with wisdom. Here are the biggest takeaways 👇

1. Great Advice Is Often Ignored—Here’s Why

Dr. Somers has spent years studying why people don’t follow good advice—even when they want to.

Preventive advice (like saving for retirement or getting a will) is often ignored because it doesn’t feel urgent, is boring, or forces us to think about uncomfortable things (like death or disability).

💬 “You’re either asking someone to delay gratification or confront an unpleasant truth—and neither feels good in the moment.”

2. Motivation Is Overrated—Systems Are Everything

If you want lasting change, don’t rely on motivation. Instead, build systems.

💡 Automatically transferring money into savings every month? That’s a system. 💡 Setting regular calendar reminders to review your finances? Another system.

Dr. Somers shared that laziness isn’t always bad—it can work in your favor when systems are designed well.

3. Advice Has Two Sides: Technical and Personal

The technical side is the math, the tax strategies, the projections. The personal side is the emotion, the history, and the meaning behind your money.

Guess which side has veto power? Yup—the personal.

Even the best tax or investment advice will fall flat if it doesn’t connect with someone’s values or life story.

4. As Advisors, We Often Talk Too Much

One of the biggest mistakes advisors make? Using too much jargon and dominating the conversation.

💬 “Clients want to feel understood, not impressed.”

Instead of showcasing credentials, we should be asking better questions, listening more, and encouraging people for what they’re already doing right.

In fact, one of our clients broke down in tears when we simply acknowledged a smart financial move they made. No one had ever told them “well done.”

5. Wealth Without Purpose Is Dangerous

Whether you’re inheriting wealth, selling a business, or retiring early, financial freedom can be disorienting if you haven’t also planned for meaning.

Work gives us structure, people, and purpose. Remove it too abruptly, and you risk spiraling into an identity crisis.

💬 “If all you’re left with is money, you’re going to be in trouble.”

That’s why we always coach clients to start building their retirement lifestyle now. Travel, move your body, join communities—don’t wait until “someday.”

6. Financial Planning Is Becoming More Human

We’re in the middle of a shift. Financial advice used to be transactional—here’s the spreadsheet, here’s your portfolio.

Now, it’s personal. Advisors who learn to navigate the emotional and behavioral side of money will be the ones who thrive.

The rest? They’ll be replaced by AI.

Want to Go Deeper?

Dr. Somers’ book Advice That Sticks is a must-read—especially if you give advice for a living.

And if you’re curious about how we’re using her ideas in our planning process, book an intro call with us.

We’re here to help you not just grow your wealth—but build a life that feels aligned, intentional, and fulfilling.

“Money is only helpful when it serves a meaningful life.”

Thanks for reading, and we’ll see you in the next issue!

Guillaume Girard, CFA CFP | Sam Lichtman, CFP

Millen Wealth Advisors

📩 Subscribe to our newsletter for more insights on finance, business, and tax-efficient strategies.

🎙️ Listen to the Millennial Money Canada Podcast on Spotify, YouTube, and Apple Podcasts.

⭐ If you enjoyed this edition, please rate our podcast and share this newsletter with fellow business owners!

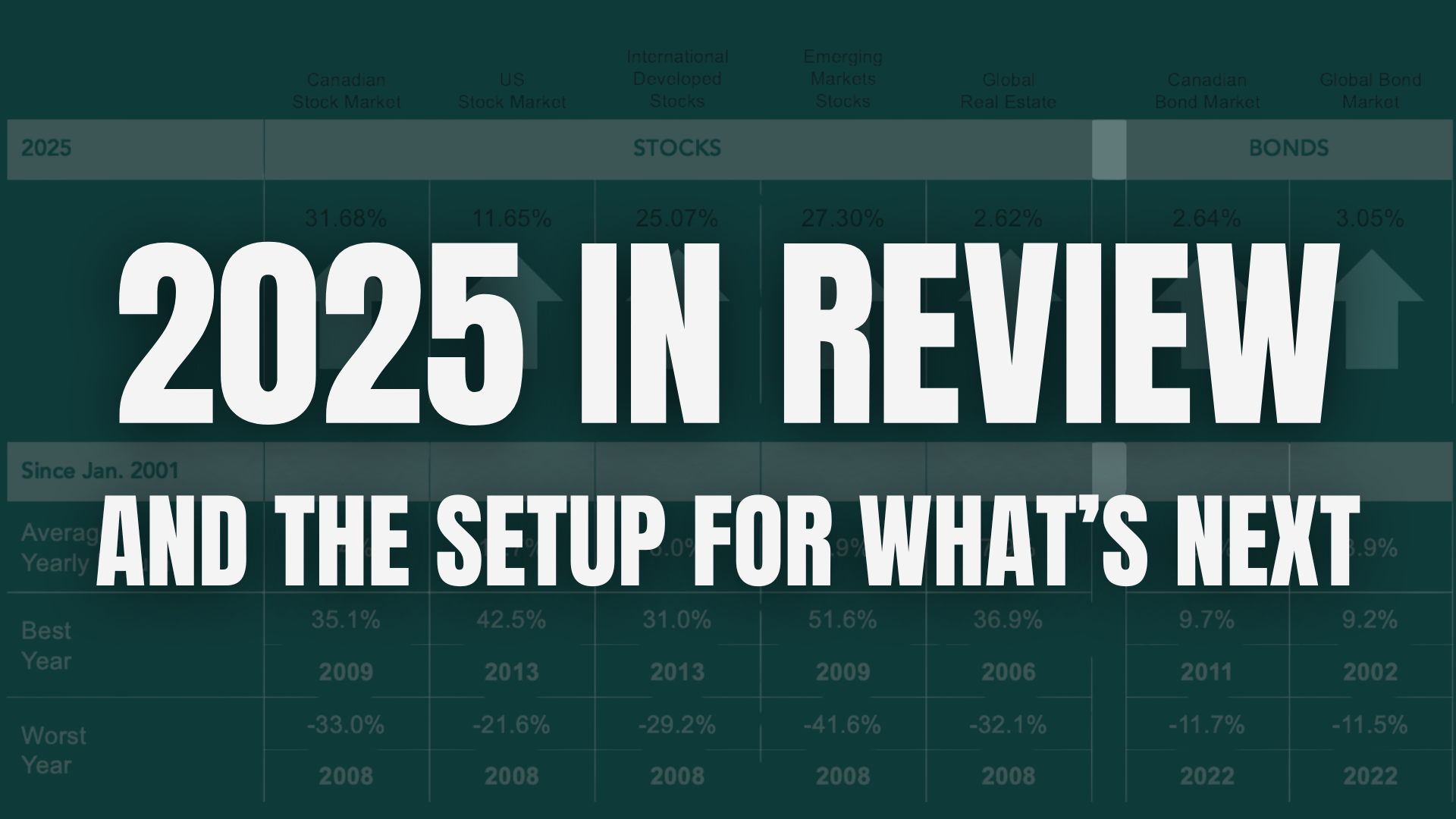

Disclaimer: Mutual funds are offered exclusively through Portfolio Strategies Corporation. Mutual fund investments are not guaranteed, as their values change frequently, and past performance may not be repeated. This message is for informational purposes only and does not constitute an offer to sell or a solicitation to buy any mutual funds. Please consider your risk tolerance and financial situation before investing, as mutual funds carry various risks depending on the nature of the fund. You should read the applicable fund facts or prospectus document carefully before investing. For personalized advice tailored to your circumstances, please contact us directly. Data and research from Dimensional Fund Advisors using Index Funds. Actual portfolio returns may vary.